2024 Bond

Frequently Asked Questions (including ballot language)

How were the projects identified?

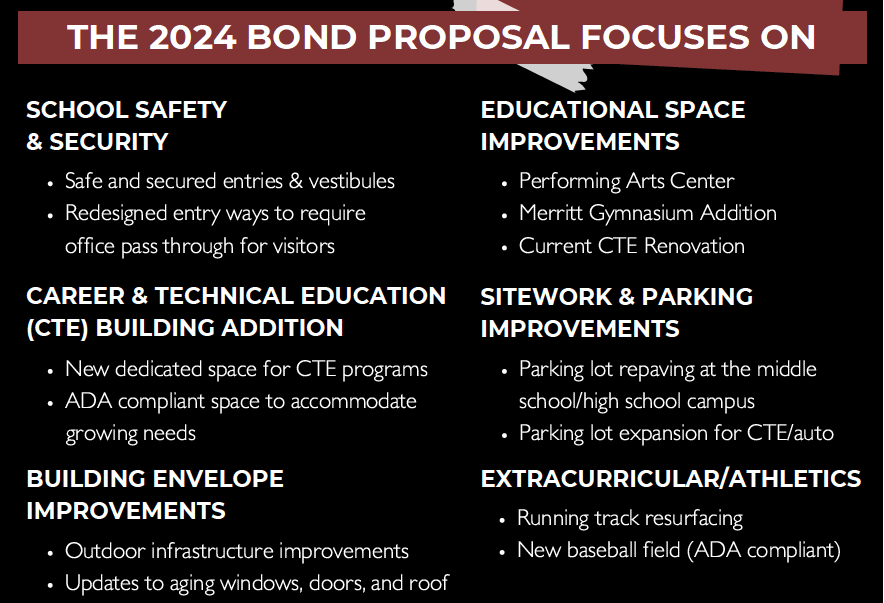

The district is continuously keeping track of facility needs as well as tracking where the district is financially. Understanding that the opportunity was approaching where we could ask the community for money to improve and enhance our facilities without raising the tax rate, we began looking at professional consulting partnerships in architects, engineers and construction management. We then had a detailed facility analysis done to examine all facilities, held meetings with district staff from maintenance, bus drivers, teachers, aids and administration to identify what their needs are. We then surveyed staff and the community to help identify needs and wants throughout our district. A bond proposal steering committee was formed, made up of community members, staff, current and former school board members as well as district administration to help narrow down and sift through the data and responses from the community forum and surveys and to ultimately identify the scope of the project.

Understanding that the district has more needs than the bond would cover without raising the tax rate, the steering committee had to narrow down the scope of critical needs and opportunities to the school board approved bond scope that the district is bringing to a vote in May.

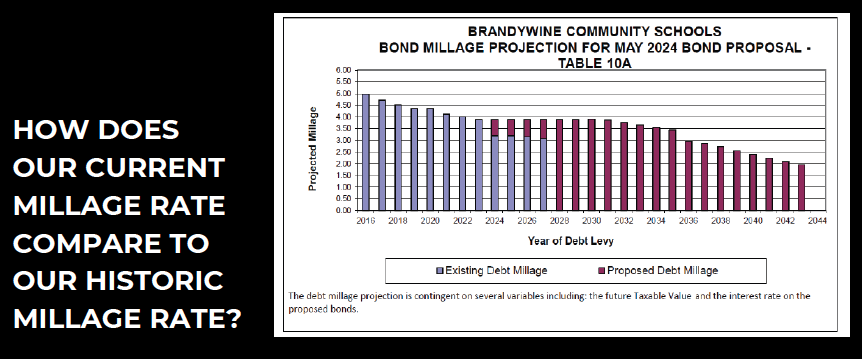

How will the bond proposal impact my taxes?

The bond is designed so that there will not be a change to the current tax rate. Meaning, the tax rate you pay now, 3.9 mills for the current debt, will remain the same. Understanding that the financial health of the community is vital to the success of our region, the district chose to limit the amount asked for so that the tax rate would not increase, even though the district’s needs exceed what is being asked for.